Dear Clients

On November 30, 2021, Jerome Powell (Chairman of the Federal Reserve) for the first time publicly admitted at a hearing in front of the U.S. Congress that he had underestimated inflation in the United States. Up to this day, Jerome Powell and the Federal Reserve had always emphasized that inflation was "just transitory".

Jerome Powell pulled a 180-degree turnaround with his recent statements:

Inflation now poses a major risk to the economic recovery and must therefore be countered. Wage pressures and price increases are seen across the board. Inflation is higher than expected and will last longer than originally thought.

The first thing the Fed will do, as announced a few weeks earlier, is to start reducing its bond purchases month by month. So-called quantitative easing would thus end in the middle of next year.

What is new since his latest statements, however, is that the FED will discuss as early as this month (December) whether it will be necessary to accelerate the scaling back of bond purchases in order to be able to discontinue them completely "a few months earlier" than planned before. According to his statements, this is now being strongly considered. A few U.S. senators asked Jerome Powell during the hearing to stop all bond purchases immediately, increasing the pressure on the central bank to end the money glut that is hurting many U.S. Americans.

To want to be ready "a few months earlier" would mean doubling the pace of rolling back bond purchases. The aim is also to create scope for raising interest rates earlier than originally planned.

Now the Fed is behind the curve and must therefore react even more strongly and quickly. It could have done this more easily if it had not refused to face reality for so long. Cost pressures, wage pressures and price increases have been evident for several quarters. Most companies have been talking about this for several quarters and are currently stating that they will have to raise their selling prices further. This has now also been admitted by the FED. Meanwhile, the ECB continues to manage inflation according to the principle of hope and currently wants to continue to pump money into the markets. When will the ECB have to give in?

What may all this mean for the markets?

Already a few days before Jerome Powell's speech on November 30, several representatives of the Fed expressed the view that bond purchases would have to be scaled back more quickly than planned. The market did not react immediately, i.e. stock prices remained stable.

When on November 30 (the day before yesterday) J. Powell then also commented on this in the aforementioned speech, the markets fell. They were somewhat surprised by his 180 degree turnaround. He was also actually like a changed and it was amazing to see him so transformed, after inflation was talked down for many months. The FED has now capitulated quite clearly and unmistakably to the increased inflation and now sees it as a priority to fight high inflation.

In the U.S., the most speculative securities in the market already began to fall more sharply several months ago and are continuing this downward trend. In addition, junk bonds (bonds with weak credit ratings) have now also been under pressure for several weeks. This indicates that investors are no longer blindly buying everything, but are now becoming more selective and have started to avoid high risks.

If interest rates are very low for a long time, discounted cash flow models can justify all prices. Compared to 0% interest rates, any investment seems good if one ignores the risks and focuses exclusively on the opportunities, which is not difficult for many after a 13-year upward trend in the stock market. But it is only in the last two years that a full-blown asset price bubble has emerged, dwarfing most of what has been seen so far.

Recently, the ECB, the Bank for International Settlements (the central bank of the central banks), the Peoples Bank of China and the U.S. Federal Reserve have also warned of market risks. One recognizes a "Irrational exuberance". These words were first used by Alan Greenspan during the Internet bubble in the 1990s and are a clear warning to investors.

Bubbles can become much bigger and last longer than one can initially imagine. Until at some point no one wants to know anything about an existing bubble, because the prices continue to rise. So it is better to be there instead of missing out.

Now the FED is hitting the brakes, and probably harder than previously expected.

What happens now to the high valuations? How do the many millions of new investors behave in a downward phase who have never experienced falling prices before? What do all those investors do who have raised their equity ratios to the highest levels ever measured in recent months? What if 0% interest rates suddenly seem better than falling share prices after all?

In recent years, the stock markets have suffered sharper price declines within a few weeks or months of each attempt by the Fed to scale back bond purchases.

The FED came under pressure as a result and always initiated a turnaround when prices fell by around 15% to 20%, i.e. it started buying bonds on the market again to prevent further price declines.

Since Corona started, the Fed has been buying bonds at a volume that is ten times as high as in any previous period. What does it mean for the market when this liquidity is withdrawn?

Moreover, today's valuation levels are much higher and the financial market many billions of USD larger (new IPO's, SPAC's, sovereign and corporate bond issues, higher valuations, etc.). Much is based on speculation and credit financed securities purchases.

How do investors justify that?

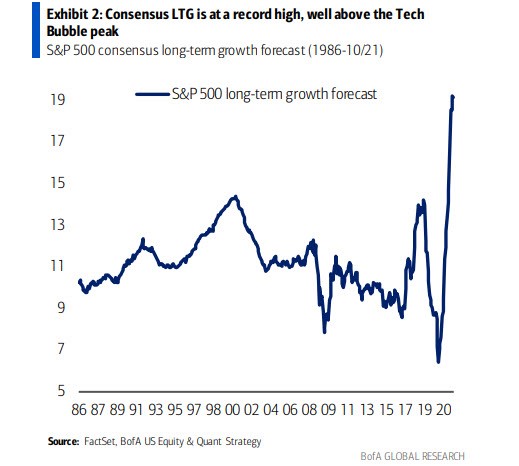

For example with future long-term growth rates set to be higher than ever before, far higher than at the previous peak during the Internet bubble:

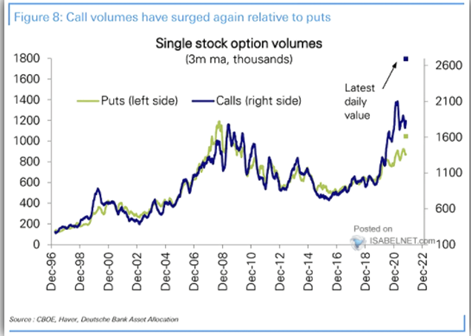

There are still more call options currently being traded than stocks themselves, and U.S. Americans took out more new loans on existing homes than at any time since 2007.

A not inconsiderable proportion of this to invest in equities, as surveys in the USA show.

The Dax is now lower than six months ago, when the fear of missing out was just at its highest. The U.S. markets have been barely moving for about three months. This year, more money flowed into U.S. equity funds and ETF's than in the previous 20 years together! The stock ratios of U.S. investors are according to evaluations of Bank of America at the highest level ever measured. Also slightly higher than the last record during the Internet bubble. Who should still buy now to let the prices continue to rise?

What if further price declines cause many to want to leave the party at the same time? With the end of its massive bond purchases, the FED at least provides a strong reason for this.

I am by no means sure that the end of the line has been reached right now. This is not the case at all. If you are really sure of something, then this is usually not a good sign on the stock market either. What can be said, however, is that from a high valuation level, the long-term return prospects are weak. At some point, investors will again demand a higher risk premium for risky assets, and then it's a long way down from such a high level.

To follow probabilities, if they are logical and comprehensible is in my opinion the better way instead of doing nonsensical things just because everybody is doing it that way and this can work well in the short term.

Please feel free to contact me for questions.

With kind regards

Björn Heissenberger